Made in China, Sold on Amazon ( Part 1)

Identifying Chinese Sellers

Recently, ECOMCREW found 63% of current Amazon sellers and 75% of new sellers are from China.

Consumers who shop on Amazon do not typically look at who is selling the product. If the product is priced fairly, has excellent reviews, and will be on their doorstep in 24 hours, why would they care who is selling the product? Amazon has done a great job giving every customer the trust and confidence in making a purchase while providing the customer with the lowest price. They also believe that if a customer is not satisfied with a purchase, they should get it refunded with no questions asked.

Marketplaces such as Amazon have propelled the US to 6% eCommerce growth from 2020 to 2021 with eCommerce representing 16% of total retail sales. According to eMarketer, this pales in comparison to China, which saw 21% growth over the same period – and eCommerce representing nearly 56% of total retail sales. Chinese seller success is quickly flowing into US marketplaces and this new competition should be a concern for US sellers.

There has been a noticeable increase of third-party sellers on Amazon over the past several years. Many of those sellers are not from the United States – they are from China. Recently, ECOMCREW found 63% of current third-party sellers and 75% of new sellers are from China.

Historically, when an American company sourced products from overseas, they applied added value onshore: a layer of quality control, customer service, branding building, retailer distribution, etc.. In today’s online marketplaces, the marketplaces are providing customer service, and (mostly) human ratings and reviews provide the quality control lens. Market – and marketing – dynamics are shifting considerably and the traditional US supply chain is being subverted. If a company sources products from outside the US, where trademarks, IP, and agreements aren’t protected, they are at risk.

Should Amazon be Concerned They Could Become a Virtual Storefront for Chinese Manufacturers, Similar to Alibaba?

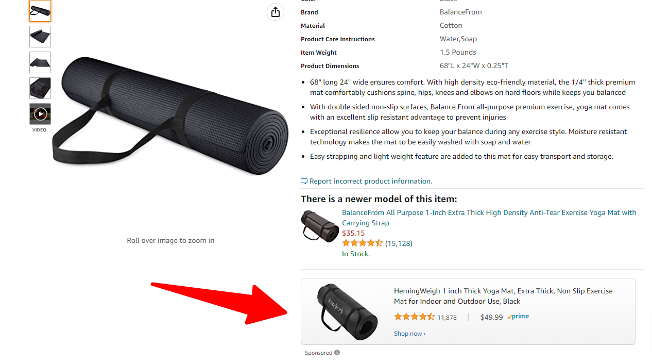

Chinese companies can essentially offer the same product at a fraction of the cost, combined with years of exporting experience. Chinese manufacturers are successfully jumping into Amazon for direct access to consumers’ wallets. Amazon remains seller agnostic; regardless of country of origin, sellers pay an average of 36% of the sale price to Amazon for commissions to sell on their marketplace as well as shipping fees. Should the American consumer care if 64% of the sale price goes to a Chinese company if the quality and value are good? As lower-priced products generally convert higher, Amazon stands to make more money in commissions and fees. If consumers are favoring lower-cost goods, Amazon and Chinese sellers both stand to make more money. Investing in growth, Amazon has added Chinese-specific support staff, training, freight solutions, and more. With US inflation rising, will pricing pressure from abroad provide a needed counterbalance?

If consumers are interested in understanding more about their purchases and the seller’s country of origin, follow these steps below.

How A Buyer Can Find A Seller’s Information On Amazon

In 2020, Amazon began to disclose every seller’s address information, accessed by clicking on the seller’s name. It’s not the easiest to find the data, however, it is there for the consumer to see.

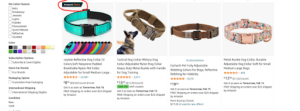

Let’s say a consumer is in the market for a new dog collar. An Amazon app search query of ‘Dog Collar’ results in the below:

![]()

After scrolling past the Sponsored Brand Ad, the first organic listing is a dog collar by Joytale. Despite the uncommon name, the Joytale listing has 22,000 reviews, multiple colors, sells for $8.99, can be delivered tomorrow, and is “Amazon’s Choice”.

Click on the listing to find out who is selling this product:

This seller looks to be the manufacturer right out of China.

The first three organic listings for ‘dog collars’ were all from Chinese manufacturers. Consumers should not only understand who is selling the products on these marketplaces but also the displacement of and disadvantages to American companies and the longer-term impacts.

Using tools such as Jungle Scout or Helium10, subscribers are able to find out revenue and even calculate margin information of sellers. If a new seller can source the product cheaper or remove a few links in the supply chain, they have a major advantage to undercut the competition. From sourcing raw materials to rising labor rates, it will continue to be challenging for an American company to compete against Chinese companies, especially on growing online marketplaces such as Amazon.

American companies do have several solutions to combat the competitors, although price typically isn’t one of them. First, it is imperative to advertise and build a brand off of Amazon. Second, be sure to use “Made in the USA” in your titles, descriptions, and images where possible. Third, engage in competitive analysis to find alternative marketplaces such as Walmart, Target, etc.. Many of the other marketplaces are invite-only and will take time to get approval. Finally, engage experienced eCommerce agencies such as aiCommerce to assist in building a brand while expanding to other marketplaces. Set up a call or fill out the form below, and a marketplace expert can assist you in learning about new opportunities.

More About aiCommerce

aiCommerce is a global digital marketing agency with a focus on retail and eCommerce marketplaces. With decades of experience, aiCommerce can help your brand grow across eCommerce channels to gain brand awareness and increase sales, all backed by our 90-day guarantee. Now is the perfect time to utilize our eCommerce experts to help grow your business. Click the button below to qualify for a free listing audit from aiCommerce to jumpstart your eCommerce growth!